goPuff: From College Campus to $9B

Highlights from ✨Hot Deal Time Machine✨⏳ -- On Clubhouse Thursdays at 8PM ET

Below are highlights from last week’s Clubhouse episode featuring Jett Fein, Partner at e.ventures, on his early investment in goPuff.

Sign up for reminders about the show ✨Hot Deal Time Machine✨ here and listen in to hear the Imperfect Foods story this Thursday.

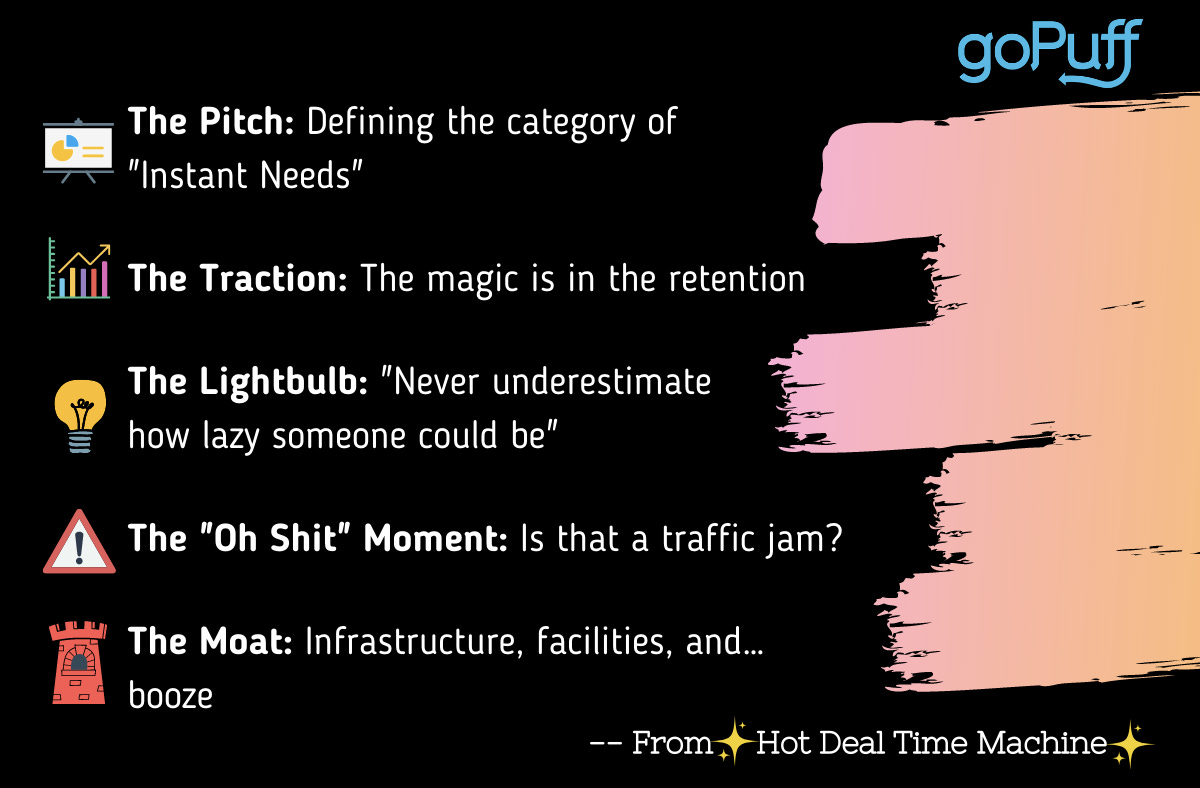

📈The Pitch: Defining the Category of “Instant Needs”

In 2015, there were already a number of delivery platforms - Uber Eats had just launched, Postmates was valued at $125M, Doordash was valued at $600M, and of course there was Amazon - the 800 lb gorilla. However, goPuff sold a story unlike any of the others. GoPuff wasn’t just a delivery platform, it was a platform for “instant needs.” GoPuff was founded on the Drexel University campus, solving the problem of how to get that Diet Coke or bag of Doritos when you need it right now (especially during the late night hours of 9PM-1AM). The answer? Vertical integration. Unlike other delivery start-ups, goPuff owns their own warehouses and inventory - meaning they fully managed the customer experience end-to-end and could provide nearly instant delivery for their customer’s needs.

🏃♂️The Early Traction: The Magic is in the Retention

Fein met goPuff founders Rafael Ilishayev and Yakir Gola at a tech conference booth advertising goPuff in 2015 (those booths can pay off!). He got to know the business over the next year, watching goPuff expand into 8 markets and consistently grow 15% MoM with strong margins. But the real magic he saw in the metrics was the retention. It was the strong retention on a per market basis as well as the fact that each market grew faster than the previous one, demonstrating goPuff’s compounding advantage when it came to market launches.

💡The Lightbulb: “Never underestimate how lazy someone could be”

Fein recalled his first ride-along with a goPuff courier as a part of his diligence process. After fulfilling the order from the warehouse shelves, he got in the car with the courier on the way to their first customer…who lived directly across the street from a 7-Eleven. This customer easily could have taken 5 minutes to run out to get her candy bar, but instead chose to have goPuff deliver it. Sometimes it takes seeing an unexpected consumer behavior to really believe it, and in Fein’s case, this ride-along gave him the conviction that there was a real market opportunity.

🤦🏻♂️The “Oh Shit” Moment: Is that a traffic jam?

GoPuff’s first market was Philadelphia, where they operated out of a small warehouse in a more residential area. As goPuff grew in popularity, there was suddenly a steady stream of cars in the area as couriers went to and from the warehouse for deliveries. Pretty soon, citizens were calling the city to report the traffic in their neighborhood. These were growing pains of a scaling company. And while it was a steep learning curve, goPuff quickly discerned where to locate warehouses, how to size them, and how to develop traffic plans to streamline operations.

🚧 The Moat: Infrastructure, facilities, and…booze

While there are a number of players in the delivery space, Fein pointed to the massive infrastructure network that goPuff has quietly built as the real differentiator. In addition to the warehouses and fulfillment centers in each geo that goPuff has stood up, the start-up’s $350M acquisition of BevMo in 2020 provides tremendous leverage as they begin expansion across California. The acquisition brings goPuff not only hundreds of prime retail locations, but also hundreds of liquor licenses - an asset that is not even available for new applicants in cities like San Francisco.

👉🏼 Up next this Thursday: we chat with Imperfect Foods co-founder Ben Chesler and seed investor, Nikhil Basu Trivedi, on how the start-up has delivered on both mission and margin

👉🏼 ✨Hot Deal Time Machine✨⏳ is a 30-minute weekly Clubhouse show where we travel back in time to the early stages of some of today’s hottest deals. Hear from founders and investors on the original pitch and thesis…and how things actually played out, Thursdays @ 8PM ET